Quoting the source off the top so you know where it came from. The sources for the article are at the bottom. I'd suggest going to the link, it looks a lot more cohesive there.

http://motherjones.com/politics/2011/02 ... hart-graph

Plutocracy Now

It's the Inequality, Stupid

Illustrations by Jason Schneider

Eleven charts that explain everything that's wrong with America.

— By Dave Gilson and Carolyn Perot

How Rich Are the Superrich?

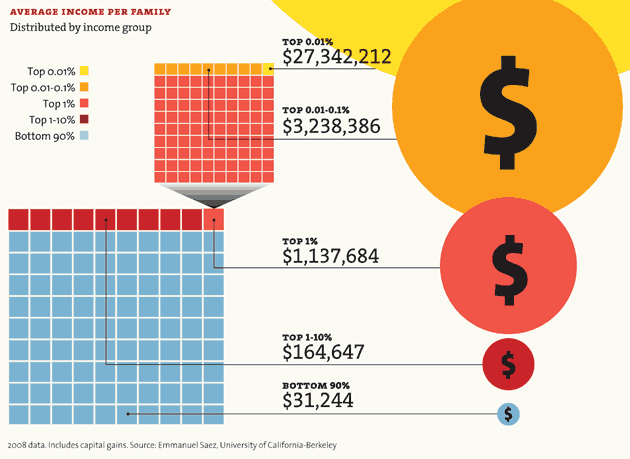

A huge share of the nation's economic growth over the past 30 years has gone to the top one-hundredth of one percent, who now make an average of $27 million per household. The average income for the bottom 90 percent of us? $31,244.

Average Income by Family, distributed by income group.

The richest controls 2/3 of America's net worth

Note: The 2007 data (the most current) doesn't reflect the impact of the housing market crash. In 2007, the bottom 60% of Americans had 65% of their net worth tied up in their homes. The top 1%, in contrast, had just 10%. The housing crisis has no doubt further swelled the share of total net worth held by the superrich.

Winners Take All

The superrich have grabbed the bulk of the past three decades' gains.

Aevrage Household income before taxes.

Out of Balance

A Harvard business prof and a behavioral economist recently asked more than 5,000 Americans how they thought wealth is distributed in the United States. Most thought that it’s more balanced than it actually is. Asked to choose their ideal distribution of wealth, 92% picked one that was even more equitable.

Average Income by Family, distributed by income group.

Capitol Gain

Why Washington is closer to Wall Street than Main Street.

median net worth of american families, median net worth for mebers of congress, your odds of being a millionaire, member of congress's odds of being a millionaire

member max. est. net worth

Rep. Darrell Issa (R-Calif.) $451.1 million

Rep. Jane Harman (D-Calif.) $435.4 million

Rep. Vern Buchanan (R-Fla.) $366.2 million

Sen. John Kerry (D-Mass.) $294.9 million

Rep. Jared Polis (D-Colo.) $285.1 million

Sen. Mark Warner (D-Va.) $283.1 million

Sen. Herb Kohl (D-Wisc.) $231.2 million

Rep. Michael McCaul (R-Texas) $201.5 million

Sen. Jay Rockefeller (D-W.Va.) $136.2 million

Sen. Dianne Feinstein (D-Calif.) $108.1 million

combined net worth: $2.8 billion

10 Richest Members of Congress 100% Voted to extend the cuts

Congressional data from 2009. Family net worth data from 2007. Sources: Center for Responsive Politics; US Census; Edward Wolff, Bard College.

Who's Winning?

For a healthy few, it's getting better all the time.

Gains and Losses in 2007-2009, Average CEO Pay vs. Average Worker Pay

A millionaire's tax rate, now and then. Share of Federal Tax revenue

YOUR LOSS,THEIR GAIN

How much income have you given up for the top 1 percent?

Sources

Income distribution: Emmanuel Saez (Excel)

Net worth: Edward Wolff (PDF)

Household income/income share: Congressional Budget Office

Real vs. desired distribution of wealth: Michael I. Norton and Dan Ariely (PDF)

Net worth of Americans vs. Congress: Federal Reserve (average); Center for Responsive Politics (Congress)

Your chances of being a millionaire: Calculation based on data from Wolff (PDF); US Census (household and population data)

Member of Congress' chances: Center for Responsive Politics

Wealthiest members of Congress: Center for Responsive Politics

Tax cut votes: New York Times (Senate; House)

Wall street profits, 2007-2009: New York State Comptroller (PDF)

Unemployment rate, 2007-2009: Bureau of Labor Statistics

Home equity, 2007-2009: Federal Reserve, Flow of Funds data, 1995-2004 and 2005-2009 (PDFs)

CEO vs. worker pay: Economic Policy Institute

Historic tax rates: Calculations based on data from The Tax Foundation

Federal tax revenue: Joint Committee on Taxation (PDF)

Read also: Kevin Drum on the decline of Big Labor, the rise of Big Business, and why the Obama era fizzled so soon.

More Mother Jones charty goodness: How the rich get richer; how the poor get poorer; who owns Congress?

Dave Gilson is a senior editor at Mother Jones. For more of his stories, click here. Get Dave Gilson's RSS feed.